Markets

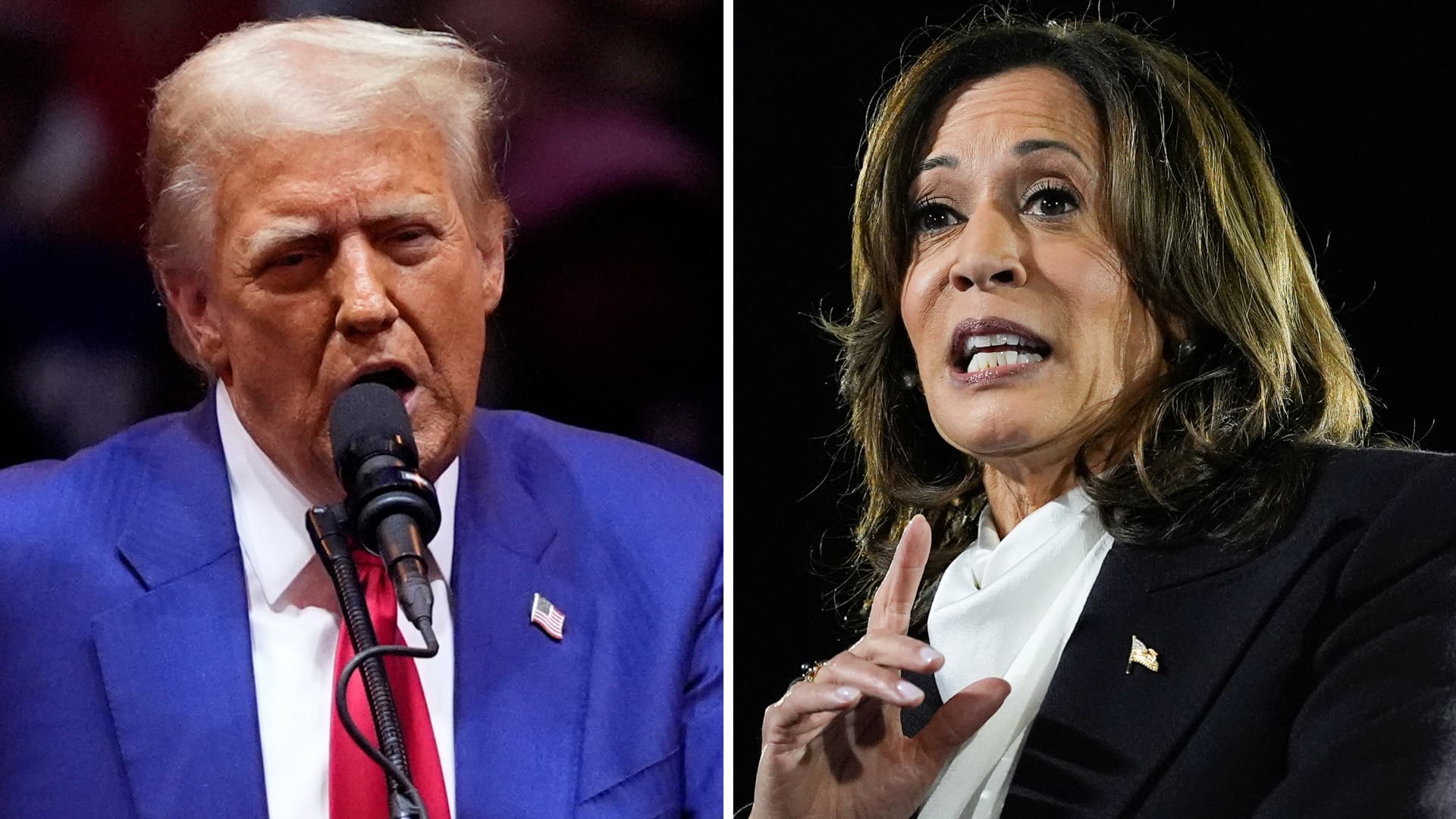

U.S. election response and retain strikes

British fintech company Sensible posts 55% bounce in benefit on increasing marketplace percentage

Sensible posted a 55% bounce in benefit within the first half of of its 2025 fiscal 12 months Wednesday, bringing up buyer enlargement and increasing marketplace percentage.

The British virtual bills company mentioned that its first-half benefit totalled £217.3 million, up from £140.6 million in the similar duration a 12 months in the past.

That got here at the again of a 25% building up in energetic shoppers, with Sensible reporting a complete of eleven.4 million shopper and trade shoppers.

Learn the overall tale right here.

— Ryan Browne

Novo Nordisk quarterly benefit meets expectancies

Gardens of Wegovy made through Novo Nordisk are clear at a pharmacy in London, Britain March 8, 2024.

Hollie Adams | Reuters

Novo Nordisk on Wednesday reported 3rd quarter profits extensively in form with expectancies and narrowed its 2024 full-year enlargement steering.

The Danish pharmaceutical vast mentioned that its web benefit within the 3rd quarter collision 27.3 billion Danish kroner ($3.92 billion), above an LSEG mixture estimate of 26.95 billion Danish kroner.

Learn the overall tale right here.

-Sophie Kiderlin

Deutsche Storagefacility maintains euro cut guess

George Saravelos, international head of FX analysis at Deutsche Storagefacility, defined that his staff had been retaining into their euro cut guess because the U.S. effects got here in.

In a analysis notice at kind of 5 a.m. U.Ok. past, simply across the past NBC Information projected Donald Trump would win North Carolina,, he mentioned:

“While at the time of publication the result is not yet confirmed, polling forecasts suggest a Trump victory is likely. We are holding on to our long-standing short EUR/USD view given the asymmetric dollar positive risks we have been highlighting throughout this year and we move our year-end EUR/USD forecast down to 1.05.”

-Matt Clinch

Markets calling election for Trump, strategist says

Steve Sosnick, well-known strategist at Interactive Agents, famous markets indicating a victory for former President Donald Trump over Vice President Kamala Harris.

“At this point right now, the market’s called it [for Trump]. Whether that turns out to be true is still not decided. That will be the interesting thing to keep an eye on,” Sosnick informed CNBC. “But again, the markets have been ahead of the pollsters, the pundits, for some time.”

Dow Jones Commercial Moderate futures soared greater than 480 issues, or 1.2%. Bitcoin, which is clear as profiting from a Trump win, collision a file and was once extreme at $74,148, up 6.7%. Treasury yieldings additionally climbed, with the benchmark 10-year notice submit buying and selling round 4.4%.

To make certain, a number of battleground states stay too alike to name or too early to name, according to NBC Information.

— Fred Imbert

Bitcoin surges to a pristine file of $75,000 as buyers guess Trump has election edge

Omar Marques | Lightrocket | Getty Pictures

Bitcoin rallied Tuesday night hitting an all-time top as traders guess former President Donald Trump was once gaining an edge within the U.S. election.

The cost of the flagship cryptocurrency touched a file $75,000 at the nostril, in keeping with Coin Metrics. Its good points larger as Trump took an early supremacy within the Electoral School, although not one of the primary swing states had been referred to as but through NBC Information.

Change operator Coinbase rose 3% in next hours buying and selling, hour MicroStrategy, complicated 4%.

For extra on bitcoin’s value motion on election night time learn our complete tale right here.

— Tanaya Macheel

10-year Treasury submit pops

Treasury yieldings jumped in early buying and selling Tuesday night as buyers noticed former President Donald Trump having an edge within the election.

The 10-year Treasury submit jumped 16 foundation issues at 4.44%, hitting its easiest degree since July 2. The submit at the 2-year Treasury was once up through 10 foundation issues to 4.30%. One foundation level is similar to 0.01%. Handovers and costs have an inverted dating.

Although not one of the primary swing states had been referred to as but through NBC Information, buyers speculated the early returns had been favoring Trump.

Bond yieldings may see a bulky pop within the tournament of a Trump win, they usually may surge in a Republican sweep, the place the birthday celebration captures regulate of Congress and the White Area. This is as a result of Republicans might introduce tax cuts and steep price lists, strikes that would widen the fiscal insufficiency and reignite inflation.

“Bonds are selling off across the yield curve massively as the Trump trade gets applied again,” wrote Byron Anderson, head of mounted source of revenue at Laffer Tengler Investments. “We see markets expecting a Trump victory and a real possibility of a Republican sweep.”

— Yun Li

CNBC Professional: Purchase those 3 shares — regardless of the election end result, analyst says

As the result of probably the most hotly contested elections within the U.S. are available in, traders are scrambling to put for the in all probability end result.

Shelby McFaddin, senior analyst at Motley Idiot Asset Control, mentioned she expects volatility this occasion, however a “limited impact on long-term investments as markets await real policy implications.”

Any bets made ahead of the consequences are ultimate are “pure speculation,” she informed CNBC’s “Street Signs Asia” on Nov. 5. “Either potential administrations would bring an increase in infrastructure spending and inflation remains a concern.”

Taking a look week the election end result, McFaddin named 3 shares she likes presently.

CNBC Professional subscribers can learn extra right here.

— Amala Balakrishner

Buyers will have to promote a Trump rally or purchase a Harris dip, says Citi’s Scott Chronert

Buyers will have to promote a possible rally available in the market if Trump wins the election, in keeping with Citi’s Scott Chronert.

“Your starting point is a fairly extended valuation circumstance that’s predicated on very strong earnings growth follow-through into 2025,” the locker’s U.S. fairness strategist informed CNBC’s “Squawk on the Street” on Tuesday. “Our concern is that with that set up, you go into a Trump win and you introduce tariffs into the discussion … [and] 2025 growth expectations become a bit more suspect as we navigate tariff action.”

At the alternative hand, if Harris is victorious, Chronert mentioned traders will have to imagine purchasing an expected marketplace dip.

“It really comes down to Trump and tariffs, and Harris and taxes,” he mentioned.

— Sean Conlon

Oil marketplace may face volatility if Trump wins, Goldman Sachs says

A 2d Trump management is much more likely to deliver volatility to the oil marketplace, in keeping with Goldman Sachs.

Donald Trump may tighten sanctions on Iran, lowering provide from the Islamic Republic and striking upward power on costs within the cut time period, the funding locker informed shoppers in a Monday notice.

Oil costs rose about 1% as electorate within the U.S. headed to the polls. U.S. crude oil had won 35 cents, or 0.49%, to $71.82 according to barrel through 8:56 a.m. ET. World benchmark Brent crude futures added 33 cents, or 0.44%, to $75.41 according to barrel.

“Conceptually, the impact of a potential second Trump term on oil prices is ambiguous,” Yulia Zhestkova Grigsby, vp of commodity analysis at Goldman Sachs, informed shoppers in a notice Monday.

Over the medium time period, alternatively, a 2d Trump management may heighten business tensions via price lists, striking downward power on international oil call for and costs, in keeping with Goldman.

— Spencer Kimball

CNBC Professional: Those 2 shares beat the S&P 500 in election Novembers regardless of who received

Two shares have outperformed the S&P 500 each and every November when elections had been held over the week 3 many years — without reference to the result, in keeping with a CNBC Professional find out about.

CNBC Professional screened for shares lately within the MSCI Global Index that won greater than the S&P 500 — or misplaced not up to the index — in November of each and every election 12 months since 1988. The 36-year duration has clear 4 Republicans and 5 Democrats elected to the White Area.

CNBC Professional subscribers can learn extra in regards to the two shares right here.

— Ganesh Rao

Eu markets: Listed here are the hole yells

Eu markets are anticipated to distinguishable decrease Wednesday.

The U.Ok.’s FTSE 100 index is anticipated to distinguishable 8 issues decrease at 8,167, Germany’s DAX ill 65 issues at 19,189, France’s CAC ill 22 issues at 7,383 and Italy’s FTSE MIB ill 134 issues at 34,098, in keeping with information from IG.

Income come from Novo Nordisk, Skanska, Lundin Petroleum, Ahold Delhaize, PUMA, Credit score Agricole, Pandora, Commerzbank, Henkel and Enel, amongst others.

— Holly Ellyatt