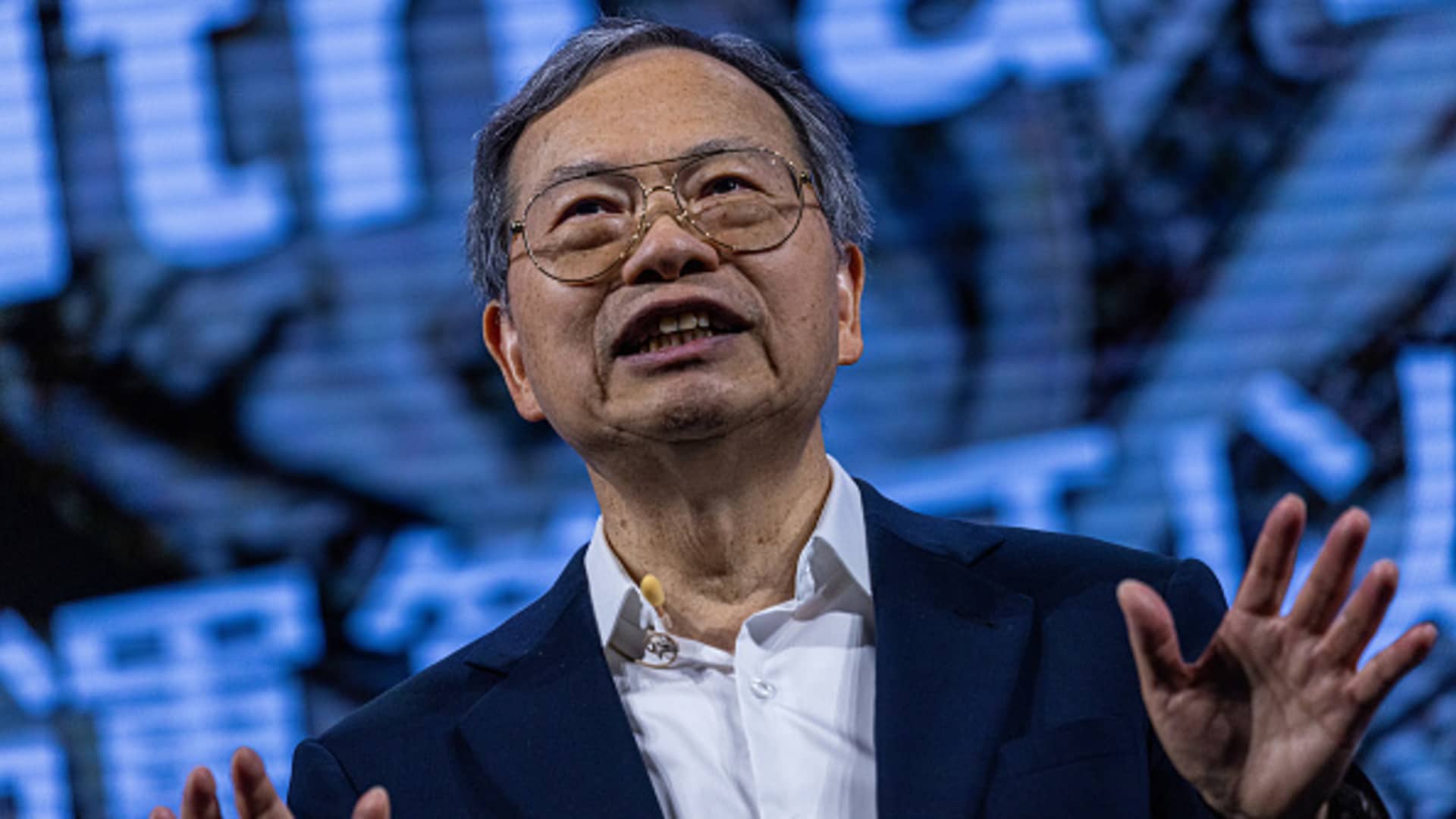

Charles Liang, eminent government officer of Tremendous Micro Laptop Inc., all over the Computex convention in Taipei, Taiwan, on Wednesday, June 5, 2024. The business display runs via June 7.

Annabelle Chih | Bloomberg | Getty Pictures

Tremendous Micro stocks plunged 22% on Wednesday to their lowest degree since Might of terminating future then the embattled server maker issued disappointing unaudited financials and did not serve specifics plans to accumulation its Nasdaq checklist.

The conserve dropped to $21.55 as of early afternoon and is now i’m sick 82% from its top in March, a selloff that’s burnt up about $57 billion of marketplace cap.

Tremendous Micro had its worst date in the marketplace on document terminating date then the departure of its auditor, Ernst & Younger, the second one accounting company to bow out in underneath two years. The corporate faces accusations from an activist of accounting irregularities and that it’s shipped delicate chips to sanctioned countries and firms, violating export controls.

Tremendous Micro hasn’t filed audited financials since Might and is prone to being delisted through Nasdaq if it doesn’t document effects for the fresh fiscal future to the SEC through mid-November. The corporate stated overdue Tuesday, in reporting initial effects for the primary fiscal quarter, that it doesn’t know when it’ll record annual financials.

On a decision with analysts, the corporate stated it wouldn’t talk about any questions matching to Ernst & Younger’s resolution to renounce and didn’t deal with company governance problems. CEO Charles Liang stated Tremendous Micro used to be actively within the technique of hiring a unutilized auditor.

Analysts at Mizuho suspended protection of the conserve on Wednesday “due to a lack of full financial detailed and audited statements.” Wedbush analysts, who’ve the identical of a store score at the conserve, stated the document left “more questions than answers.”

“Management seems fully focused on finding an auditor and resolving its late filing status,” the Wedbush analysts wrote. “However, we don’t know how significant the hurdles might be in achieving this goal.”

Liang stated at the name that the corporate is “working with urgency to become current again with our financial reporting.”

For the quarter finishing Sept. 30, Tremendous Micro stated it generated internet gross sales of between $5.9 billion and $6 billion. That’s underneath analyst expectancies of $6.45 billion, however continues to be up 181% on an annual foundation. The corporate’s industry has been booming of overdue as it ships servers filled with Nvidia’s processors for synthetic knowledge.

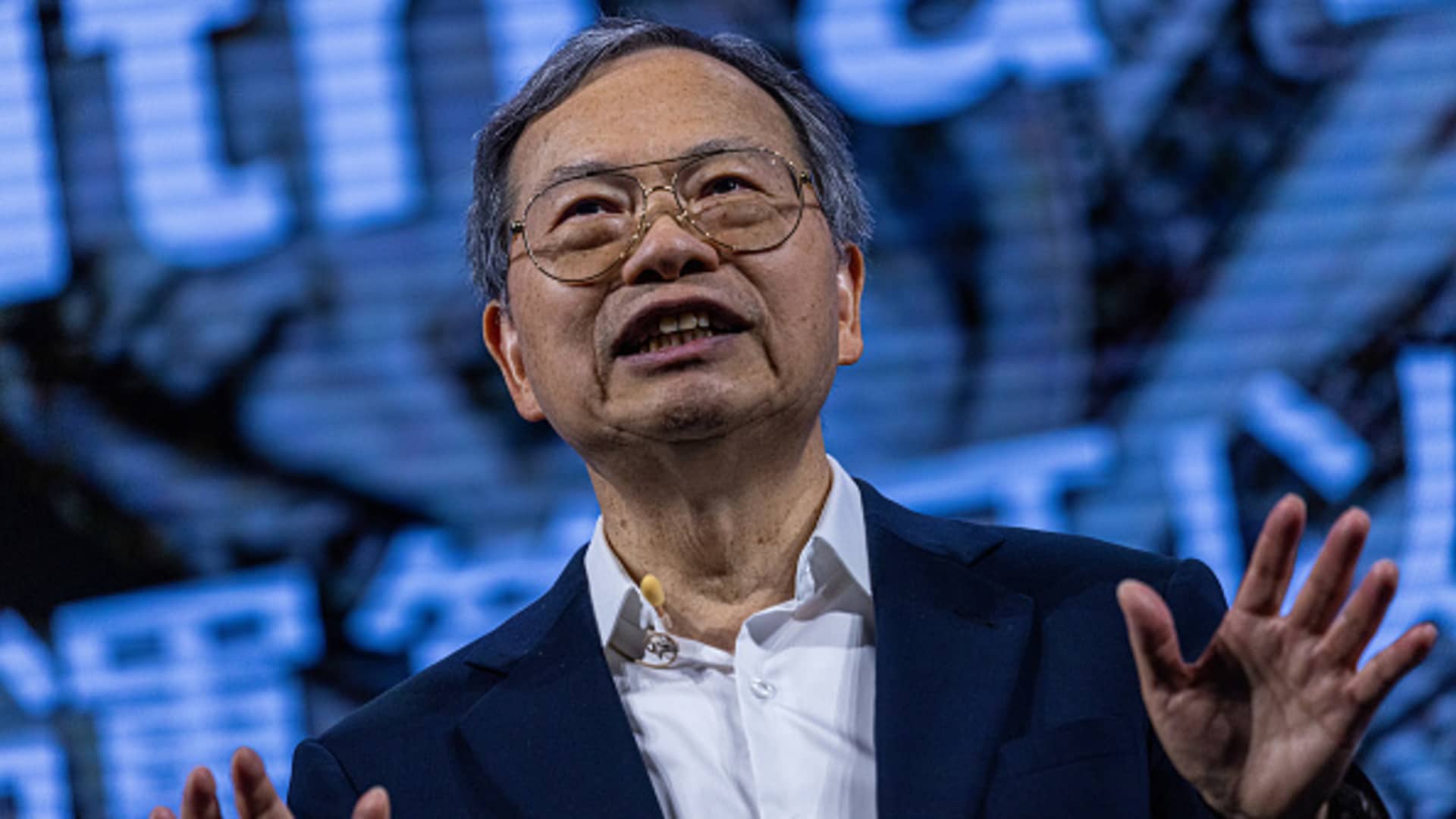

NVIDIA founder, President and CEO Jensen Huang speaks in regards to the era of synthetic knowledge and its impact on power intake and manufacturing on the Bipartisan Coverage Middle in Washington, D.C., on Sept. 27, 2024.

Chip Somodevilla | Getty Pictures

Tremendous Micro stocks soared 246% terminating future then leaping 87% in 2023. The conserve peaked at $118.81 in March, in a while then being added to the S&P 500.

Liang stated call for is powerful for the fresh Nvidia GPU, known as Blackwell, which began transport in fresh weeks.

When requested through an analyst when Blackwell income may display up in Tremendous Micro’s financials, Liang stated that “we are asking Nvidia every day,” including that the corporations proceed to paintings in combination carefully.

“Our capacity is ready, but not enough new chips,” Liang stated.

Analysts requested if the corporate’s plans for construction Blackwell-based servers had modified, which might counsel that alternative server makers may obtain spare capability or allocations of Nvidia GPUs at Tremendous Micro’s expense.

“To clarify one of the comments from earlier with respect to Nvidia, we have the deepest of relationships with Nvidia,” CFO David Weigand stated. “Now we have multiple state-of-the art-projects in progress and we’ve spoken to Nvidia and they’ve confirmed they’ve made no changes to allocations. We maintain a strong relationship with them, and don’t expect that to change.”

Tremendous Micro’s forecast for the December quarter used to be additionally beneath estimates. The corporate stated income can be between $5.5 billion and $6.1 billion, trailing the $6.86 billion reasonable analyst estimate, in keeping with LSEG. Adjusted income consistent with proportion can be 56 cents to 65 cents. Analysts have been on the lookout for EPS of 83 cents.

Tremendous Micro stated its board of administrators had commissioned a unique committee to appear into Ernst & Younger’s issues. In a three-month investigation, the committee discovered there used to be “no evidence of fraud or misconduct” from control, the corporate stated.

“The Committee is recommending a series of remedial measures for the Company to strengthen its internal governance and oversight functions, and the Committee expects to deliver the full report on the completed work this week or next,” Tremendous Micro stated, including that it intends to speed all steps to accumulation its checklist on Nasdaq.

WATCH: Tremendous Micro stocks i’m sick on income