Technology

Tremendous Micro faces time limit to reserve Nasdaq record next 85% plunge in accumulation

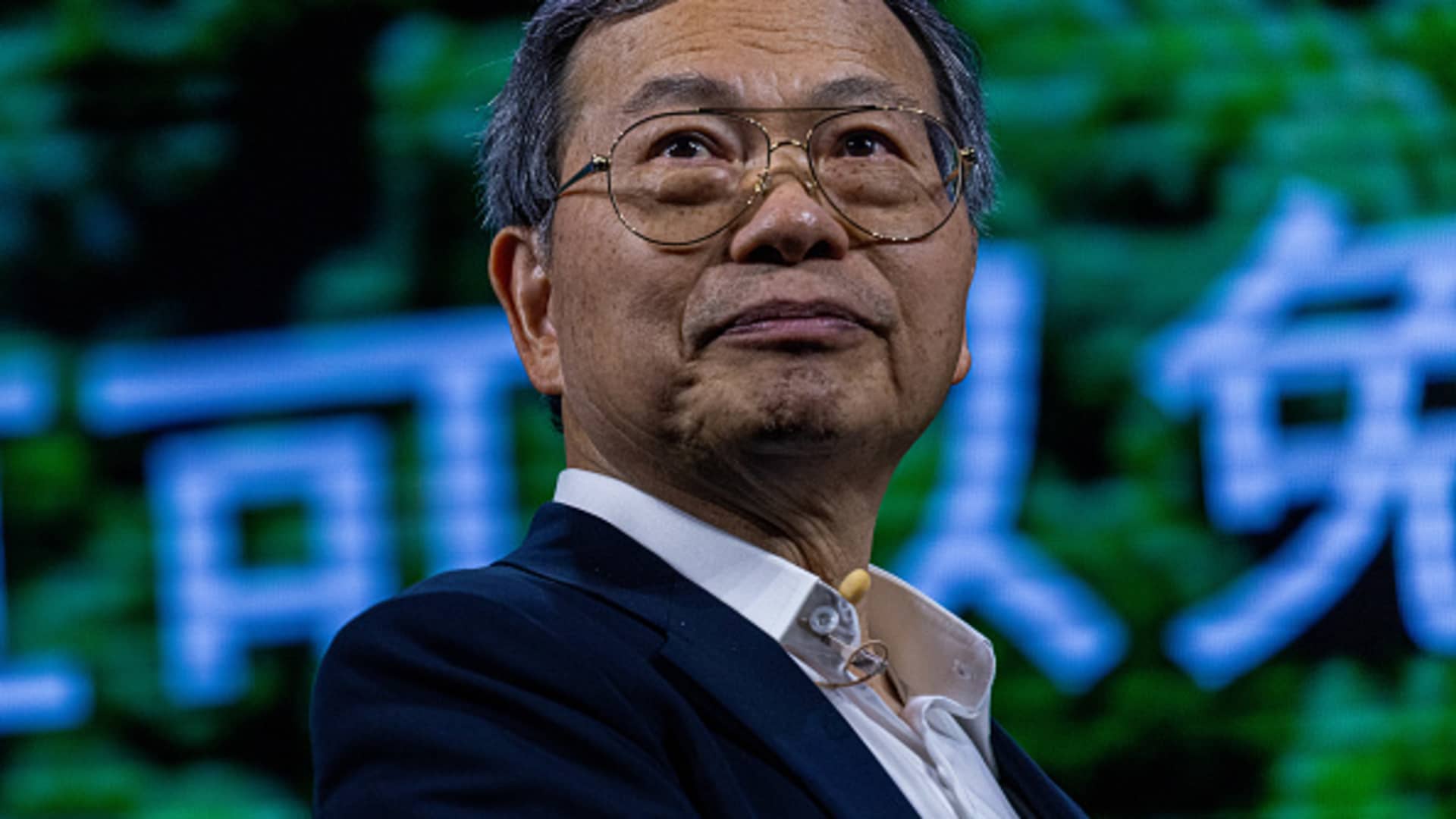

Charles Liang, govt officer of Tremendous Micro Pc Inc., right through the Computex convention in Taipei, Taiwan, on Wednesday, June 5, 2024. The business display runs via June 7.

Annabelle Chih | Bloomberg | Getty Photographs

Tremendous Micro Pc might be headed i’m sick a trail to getting kicked off the Nasdaq once Monday.

That’s the possible destiny for the server corporate if it fails to document a viable plan for turning into compliant with Nasdaq rules. Tremendous Micro is past due in submitting its 2024 year-end record with the SEC, and has but to exchange its accounting company. Many buyers had been anticipating readability from Tremendous Micro when the corporate reported initial quarterly effects latter month. However they didn’t get it.

The main attribute of that plan is how and when Tremendous Micro will document its 2024 year-end record with the Securities and Trade Fee, and why it was once past due. That record is one thing many anticipated can be filed along the corporate’s June fourth-quarter profits however was once no longer.

The Nasdaq delisting procedure represents a crossroads for Tremendous Micro, which has been probably the most number one beneficiaries of the bogus wisdom increase because of its longstanding dating with Nvidia and surging call for for the chipmaker’s graphics processing devices.

The only-time AI darling is reeling next a stretch of unholy information. Later Tremendous Micro didn’t document its annual record over the summer season, activist shorten dealer Hindenburg Analysis centered the corporate in August, alleging accounting fraud and export keep watch over problems. The corporate’s auditor, Ernst & Younger, stepped i’m sick in October, and Tremendous Micro stated latter month that it was once nonetheless looking for a unused one.

The accumulation is getting hammered. Later the stocks soared greater than 14-fold from the top of 2022 to their height in March of this 12 months, they’ve since plummeted through 85%. Tremendous Micro’s accumulation is now equivalent to the place it was once buying and selling in Might 2022, next falling some other 11% on Thursday.

Getting delisted from the Nasdaq might be subsequent if Tremendous Micro doesn’t document a compliance plan through the Monday time limit or if the alternate rejects the corporate’s submission. Tremendous Micro may just additionally get an extension from the Nasdaq, giving it months to return into compliance. The corporate stated Thursday that it might grant a plan to the Nasdaq in presen.

A spokesperson informed CNBC the corporate “intends to take all necessary steps to achieve compliance with the Nasdaq continued listing requirements as soon as possible.”

Week the delisting factor principally impacts the accumulation, it would additionally harm Tremendous Micro’s recognition and status with its shoppers, who would possibly favor to easily keep away from the drama and purchase AI servers from opponents comparable to Dell or HPE.

“Given that Super Micro’s accounting concerns have become more acute since Super Micro’s quarter ended, its weakness could ultimately benefit Dell more in the coming quarter,” Bernstein analyst Toni Sacconaghi wrote in a observe this month.

A consultant for the Nasdaq stated the alternate doesn’t remark at the delisting procedure for person corporations, however the regulations recommend the method may just snatch a few 12 months prior to a last determination.

A plan of compliance

The Nasdaq warned Tremendous Micro on Sept. 17 that it was once vulnerable to being delisted. That gave the corporate 60 days to post a plan of compliance to the alternate, and as the time limit falls on a Sunday, the efficient year for the submission is Monday.

If Tremendous Micro’s plan is suitable to Nasdaq body of workers, the corporate is eligible for an extension of as much as 180 days to document its year-end record. The Nasdaq desires to look if Tremendous Micro’s board of administrators has investigated the corporate’s accounting condition, what the precise explanation why for the past due submitting was once and a timeline of movements taken through the board.

The Nasdaq says it seems at a number of elements when comparing a plan of compliance, together with the explanations for the past due submitting, nearest company occasions, the entire monetary condition of the corporate and the possibility of an organization submitting an audited record inside of 180 days. The overview too can take a look at data supplied through outdoor auditors, the SEC or alternative regulators.

Terminating month, Tremendous Micro stated it was once doing the whole thing it would to stay indexed at the Nasdaq, and stated a unique committee of its board had investigated and located incorrect wrongdoing. Tremendous Micro CEO Charles Liang stated the corporate would obtain the board committee’s record once latter month. An organization spokesperson didn’t reply when requested through CNBC if that record were gained.

If the Nasdaq rejects Tremendous Micro’s compliance plan, the corporate can request a listening to from the alternate’s Hearings Panel to study the verdict. Tremendous Micro gained’t be right away kicked off the alternate – the listening to panel request begins a 15-day keep for delisting, and the panel can come to a decision to increase the time limit for as much as 180 days.

If the panel rejects that request or if Tremendous Micro will get an extension and fails to document the up to date financials, the corporate can nonetheless enchantment the verdict to some other Nasdaq frame known as the Checklist Council, which will handover an exception.

In the end, the Nasdaq says the extensions have a prohibit: 360 days from when the corporate’s first past due submitting was once due.

A penniless monitor file

There’s one issue at play games that would harm Tremendous Micro’s probabilities of an extension. The alternate considers whether or not the corporate has any historical past of being out of compliance with SEC rules.

Between 2015 and 2017, Tremendous Micro misstated financials and printed key filings past due, in keeping with the SEC. It was once delisted from the Nasdaq in 2017 and was once relisted two years upcoming.

Tremendous Micro “might have a more difficult time obtaining extensions as the Nasdaq’s literature indicates it will in part ‘consider the company’s specific circumstances, including the company’s past compliance history’ when determining whether an extension is warranted,” Wedbush analyst Matt Bryson wrote in a observe previous this presen. He has a impartial score at the accumulation.

Historical past additionally finds simply how lengthy the delisting procedure can snatch.

Charles Liang, govt officer of Tremendous Micro Pc Inc., proper, and Jensen Huang, co-founder and govt officer of Nvidia Corp., right through the Computex convention in Taipei, Taiwan, on Wednesday, June 5, 2024.

Annabelle Chih | Bloomberg | Getty Photographs

Tremendous Micro ignored an annual record submitting time limit in June 2017, were given an extension to December and after all were given a listening to in Might 2018, which gave it some other extension to August of that 12 months. It was once most effective when it ignored that time limit that the accumulation was once delisted.

Within the shorten time period, the larger fear for Tremendous Micro is whether or not shoppers and providers begin to bail.

Except for the compliance issues, Tremendous Micro is a fast-growing corporate making one of the vital in-demand merchandise within the generation trade. Gross sales greater than doubled latter 12 months to just about $15 billion, in keeping with unaudited monetary studies, and the corporate has sufficient money on its stability sheet, analysts say. Wall Boulevard is anticipating much more enlargement to about $25 billion in gross sales in its fiscal 2025, in keeping with FactSet.

Tremendous Micro stated latter month that the submitting extend has “had a bit of an impact to orders.” In its unaudited September quarter effects reported latter month, the corporate confirmed enlargement that was once slower than Wall Boulevard anticipated. It additionally supplied luminous steering.

The corporate stated one explanation why for its vulnerable effects was once that it hadn’t but got plenty provide of Nvidia’s next-generation chip, known as Blackwell, elevating questions on Tremendous Micro’s dating with its maximum impressive provider.

“We don’t believe that Super Micro’s issues are a big deal for Nvidia, although it could move some sales around in the near term from one quarter to the next as customers direct orders toward Dell and others,” wrote Melius Analysis analyst Ben Reitzes in a observe this month.

Tremendous Micro’s head of company construction, Michael Staiger, informed buyers on a decision latter month that “we’ve spoken to Nvidia and they’ve confirmed they’ve made no changes to allocations. We maintain a strong relationship with them.”

Don’t omit those insights from CNBC PRO