Federal Conserve Chairman Jerome Powell mentioned Thursday that robust U.S. monetary expansion will permit policymakers to remove their while in deciding how a ways and how briskly to decrease rates of interest.

“The economy is not sending any signals that we need to be in a hurry to lower rates,” Powell mentioned in remarks for a pronunciation to industry leaders in Dallas. “The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”

(Guard Powell’s remarkets reside right here.)

In an upbeat evaluate of wave statuses, the central store chief known as home enlargement “by far the best of any major economy in the world.”

In particular, he mentioned the exertions marketplace is conserving up neatly regardless of disappointing process enlargement in October in large part that he attributed to typhoon injury within the Southeast and exertions moves. Nonfarm payrolls higher by way of simply 12,000 for the duration.

Powell famous that the unemployment charge has been emerging however has flattened out in fresh months and left-overs low by way of ancient requirements.

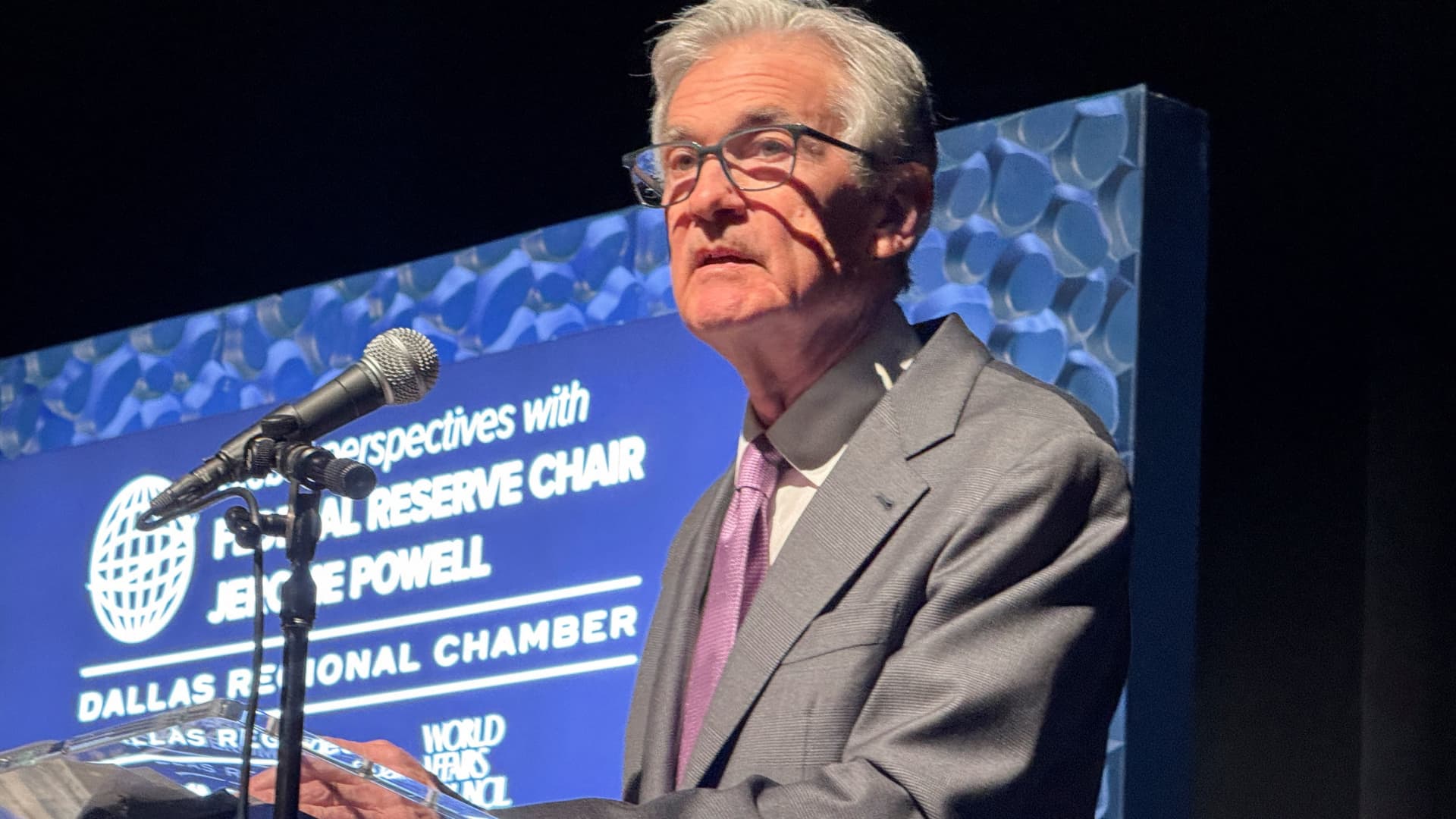

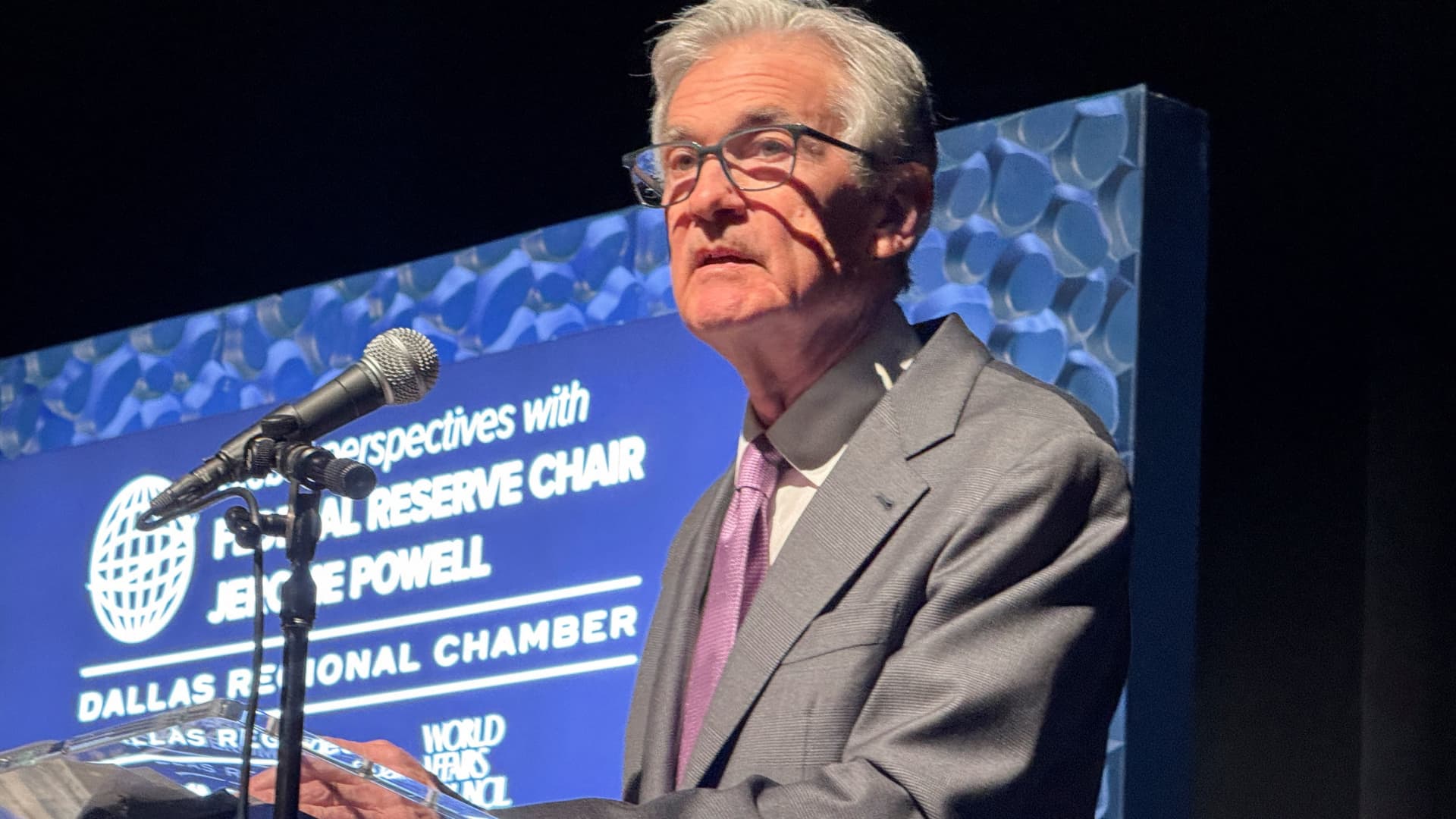

Federal Conserve Chair Jerome Powell delivers remarks in Dallas, Texas, U.S., November 14, 2024.

Ann Saphir | Reuters

At the query of inflation, he cited advance that has been “broad based,” noting that Fed officers be expecting it to proceed to flow again against the central store’s 2% purpose. Inflation information this pace, although, confirmed a negligible uptick in each shopper and manufacturer costs, with 12-month charges pulling additional clear of the Fed mandate.

Nonetheless, Powell mentioned the 2 indexes are indicating inflation by way of the Fed’s most popular measure at 2.3% in October, or 2.8% except for meals and effort.

“Inflation is running much closer to our 2 percent longer-run goal, but it is not there yet. We are committed to finishing the job,” mentioned Powell, who famous that obtaining there might be “on a sometimes-bumpy path.”

Powell’s wary view on charge cuts despatched shares decrease and Treasury turnovers upper. Investors additionally diminished their expectancies for a December charge scale down.

The remarks come a pace nearest the Federal Revealed Marketplace Committee diminished the central store’s benchmark borrowing charge by way of 1 / 4 share level, pushing it indisposed right into a area between 4.5%-4.75%. That adopted a half-point scale down in September.

Powell has known as the strikes a recalibration of economic coverage that now not must be targeted totally on stomping out inflation and now has a balanced effort at maintaining the exertions marketplace as neatly. Markets nonetheless in large part be expecting the Fed to proceed with any other quarter-point scale down in December and next a couple of extra in 2025.

On the other hand, Powell was once noncommittal when it got here to offering his personal forecast. The Fed is looking for to steer its key charge right down to a impartial surroundings that neither boosts nor inhibits enlargement, however isn’t certain what the tip level will likely be.

“We are confident that with an appropriate recalibration of our policy stance, strength in the economy and the labor market can be maintained, with inflation moving sustainably down to 2 percent,” he mentioned. “We are moving policy over time to a more neutral setting. But the path for getting there is not preset.”

The Fed additionally has been permitting proceeds from its bond holdings to roll off its mammoth stability sheet every life. There were disagree indications of when that procedure may finish.