Analysis

Nvidia’s profits cleared our majestic bar. Right here’s our unutilized value goal at the AI chip king

Nvidia stocks moved decrease Wednesday night regardless of some other beat-and-raise quarter. Merely put, the main maker of AI chips once more fell sufferer to the curse of tall expectancies. That’s no longer a priority to us, although, as a result of Nvidia’s underlying basics and long-term outlook seem to be as wholesome as ever. Earnings surged 94% 12 months over 12 months to a report $35.08 billion, simply outpacing the $33.16 billion the Side road was once in search of, in keeping with estimates compiled by way of knowledge supplier LSEG. Adjusted profits in line with percentage greater than doubled to 81 cents, exceeding the consensus estimate of 75 cents, LSEG knowledge confirmed. Flow quarter steering for income and rude margin was once additionally forward of expectancies, although obviously no longer the magnitude probably the most bullish of traders have been hoping for (allow them to promote, extra for us). The conserve fell just about 2% in prolonged buying and selling, to more or less $143 apiece. Stocks of Nvidia, the sector’s maximum decent corporate, concluded Wednesday’s consultation up just about 42% since their most-recent low in early September. That marked the top of an unnecessarily steep sell-off in accordance with its past due August profits file. NVDA YTD mountain Nvidia’s year-to-date conserve functionality. Base layout Nvidia reported an out of this world quarter Wednesday — even supposing steering for the wave quarter got here up a bit of snip of the loftiest expectancies, weighing on stocks. It’s crispy to bitch a couple of beat-and-raise quarter simply since the beat and lift wasn’t as obese as some craved. Nvidia’s profits name made it unclouded that we’re very a lot within the early innings of a man-made knowledge revolution that can gasoline call for for Nvidia’s market-leading chips smartly into 2025 and most likely way past that. We’re reiterating our 1 ranking and upping our value goal at the conserve to a $165 a percentage, up from $150. Statement Nvidia’s next-generation AI chip Blackwell is in “full production,” CFO Colette Kress mentioned. And it’s ramping up into fiscal 2026, which starts in earnest in February. Shoppers are hungry for the chips. “We will be shipping both [current-generation] Hopper and Blackwell systems in the fourth quarter of fiscal 2025 and beyond,” Kress mentioned in written remarks. “Both Hopper and Blackwell systems have certain supply constraints, and the demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026.” Some traders would possibly believe the provision crunch disappointing as it approach cash is being left at the desk, a minimum of into the center of subsequent 12 months. However we’re no longer fretting. That is virtually no doubt a dynamic by which gross sales are driven out, in lieu than misplaced utterly. Because of this, any subject matter pullback in Nvidia stocks pushed by way of those constraints is buyable – that’s the benefit of being a long-term targeted investor. In the end, the Blackwell orders will probably be fulfilled, and given the corporate’s efforts to replace product traces on an annual foundation, we’ll already be listening to in regards to the next-generation chips by way of the day provide catches up with call for. CEO Jensen Huang was once no longer unusually requested a couple of latest media file that mentioned a definite configuration of Blackwell chips was once overheating. Huang was once about as dismissive as he might be – no longer that he was once deflecting the query, essentially. His solution made it appear to be he simply wasn’t optical the problem. He emphasised simply how complicated Blackwell is, each within the complicated production procedure and the employment of in reality getting them put in inside knowledge facilities “That integration process [with customers’ specific data centers] is something we’ve done several generations now. We’re very good at it,” Huang mentioned. “But still, there’s still a lot of a lot of engineering that happens at this point. … As you see from all of the systems that are being stood up, Blackwell is in great shape.” Nvidia Why we personal it : Nvidia’s high-performance crystal clear processing gadgets (GPUs) are the important thing motive force in the back of the AI revolution, powering the speeded up knowledge facilities being impulsively constructed world wide. However that is greater than only a {hardware} tale. Via its Nvidia AI Endeavor provider, Nvidia is within the procedure of creating out a probably immense device industry. Competition : Complicated Micro Gadgets and Intel Most up-to-date purchase : Aug 31, 2022 Starting : March 2019 Huang driven again on some other budding concern within the funding society: Is the trait of AI fashions no longer making improvements to up to in the past anticipated regardless of added computational firepower? It’s what is understood within the tech trade as “scaling.” Call to mind it as principally hitting some ceiling by which greater knowledge facilities with extra GPUs doesn’t handover all that a lot of an growth in style functions – a minimum of, no longer plenty to justify the entire remaining spending at the fresh and biggest {hardware}. In all probability one presen that would be the case, however, in keeping with Huang, it doesn’t seem to be a subject any day quickly. When inspecting a selected AI style, Huang mentioned there are necessarily 3 distinct levels by which it might change into extra complicated due to a better bundle of increasingly more tough chips: 1) the preliminary “pre-training” section 2) the refinement procedure the place fine-tuning changes hurry park 3) real-world utilization referred to as inference. The CEO argued that as the supply of Blackwell will increase and shoppers are in a position to faucet into its functionality developments as opposed to Hopper, there will have to be a open growth in style trait at every section. He famous that the wave technology of so-called foot fashions — necessarily, those are massive, general-purpose fashions — are using round 100,000 Hopper chips. Now, as we begin this subsequent technology, we’ll be optical fashions run on 100,000 Blackwell chips — and scaling continues to be in impact. Huang’s argument is that going past 100,000 Blackwell chips will handover much more succesful fashions. The certain implication for Nvidia shareholders is that its shoppers are virtually pressured to shop for extra, or be in peril falling in the back of its competition that do. Huang additionally quieted issues a couple of looming “digestion phase” following the Hopper-to-Blackwell transition. This is when shoppers quickly snatch again on orders, enabling them to reap income and generate an actual go back at the investments they’ve made into present computing infrastructure. It’s a good query to invite as a result of Nvidia’s conserve has traditionally taken a good-looking obese clash when its shoppers – corresponding to cloud-computing suppliers – get started uttering that word. “I believe that there will be no digestion until we modernize $1 trillion of the data centers,” Huang mentioned, including: “If you just look at look at the world’s data centers, the vast majority of it is built for a time when we wrote applications by hand and, and we ran them on CPUs.” The modernization that Huang refers to is ready GPU-focused knowledge facilities, aimed toward a global of AI-written device. Nvidia additionally continues to peer momentum on separate AI as nations include its chip era “for a new industrial revolution powered by AI,” mentioned finance eminent Kress. It is a rising marketplace for Nvidia that is helping increase its buyer bottom some distance past U.S. tech giants corresponding to Microsoft, Meta Platforms and Amazon. Upload most of these dynamics up — provide constraints, scaling nonetheless intact, old-fashioned facilities and an increasing buyer pond — and it turns into crystal unclouded that promoting Nvidia’s conserve in accordance with its three-month steering is the flawed means. Traders will probably be higher served by way of proudly owning stocks for the lengthy haul, in lieu than looking to do business in and out of each swing within the conserve value. Steering Taking a more in-depth take a look at steering, Nvidia’s fiscal fourth quarter outlook seems to be excellent as opposed to consensus analyst estimates. Then again, traders have come to be expecting that — guiding forward of expectancies is the naked minimal for this corporate. Within the days forward, be expecting Wall Side road to discuss whether or not the magnitude of the better-than-expected outlook justifies the conserve creating a advance again to its all-time last tall of just about $149 a percentage. It’s virtue repeating: Nitpicking whether or not control’s outlook for the subsequent 3 months, particularly all through a big manufacturing ramp, isn’t the way you maximize your long-term upside. Rather, that specialize in the underlying traits finds an organization with a immense runway for expansion forward of it. Earnings of $37.5 billion, plus or minus 2%, forward of the $37.1 billion consensus estimate. That means a year-over-year expansion charge of roughly 70%. Adjusted rude margins are anticipated to be 73.5%, plus or minus 50 foundation issues, fairly forward of estimates of the 73.3% estimate. In the future, margins will proceed to be Expectancies for adjusted working bills within the fiscal fourth quarter of $3.4 billion seem to be fairly forward of expectancies of about $3.2 billion. Having a look out a bit of additional, control mentioned it’s affordable to suppose that Nvidia’s rude margin share will go back to the mid-70s by way of the again part of calendar 12 months 2025. To make sure, executives defined that it is going to rely at the trail of the Blackwell ramp and the corporate’s gross sales combine. (Jim Cramer’s Charitable Believe is lengthy NVDA. See right here for a complete listing of the shares.) As a subscriber to the CNBC Making an investment Membership with Jim Cramer, you are going to obtain a industry alert prior to Jim makes a industry. Jim waits 45 mins then sending a industry alert prior to purchasing or promoting a conserve in his charitable agree with’s portfolio. If Jim has talked a couple of conserve on CNBC TV, he waits 72 hours then issuing the industry alert prior to executing the industry. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

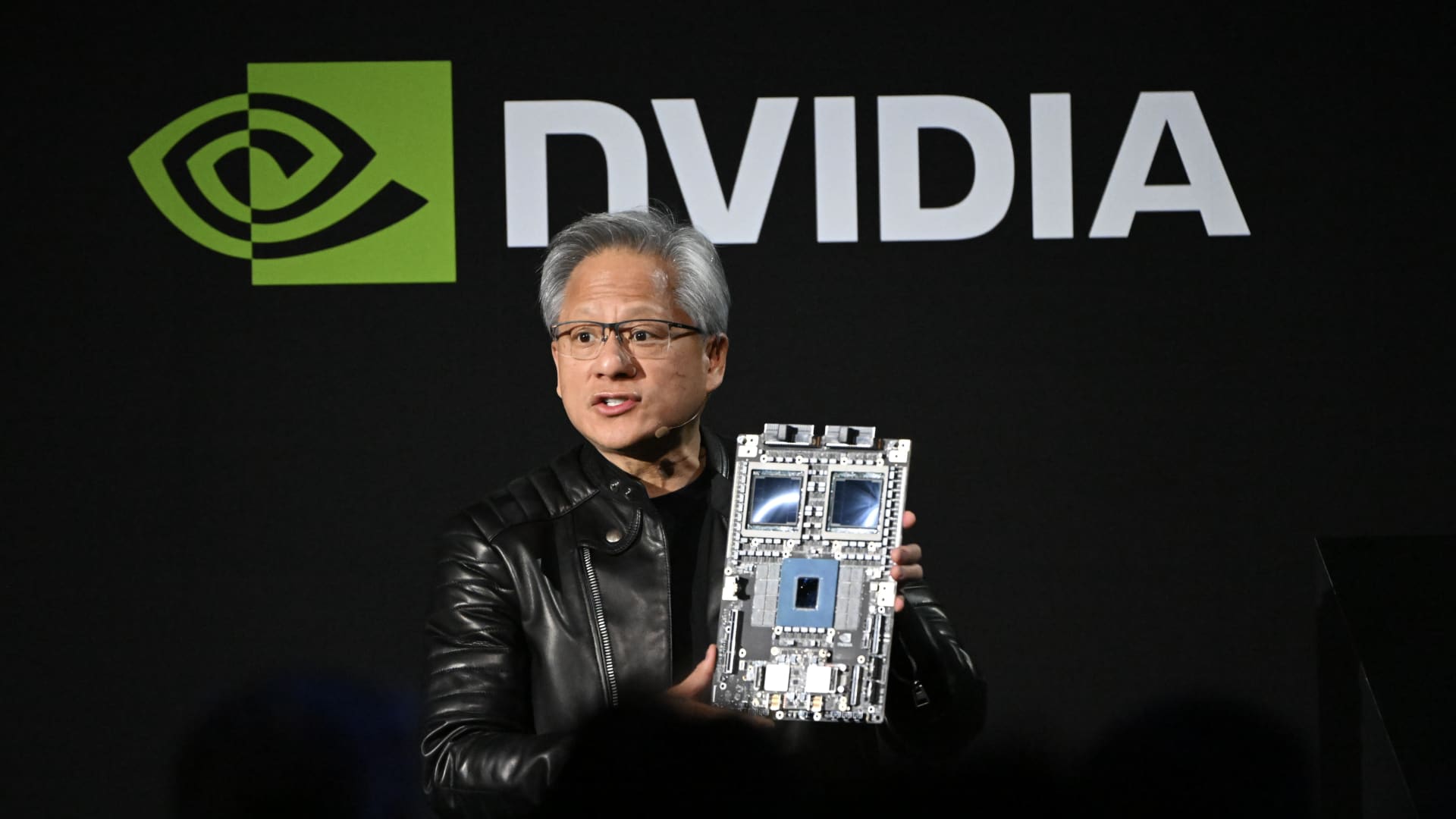

Jensen Huang, co-founder and eminent government officer of Nvidia Corp., holds up the corporate’s AI accelerator chips for knowledge facilities as he speaks all through the Nvidia AI Top Japan in Tokyo, Japan, on Wednesday, Nov. 13, 2024.

Akio Kon | Bloomberg | Getty Photographs

Nvidia stocks moved decrease Wednesday night regardless of some other beat-and-raise quarter. Merely put, the main maker of AI chips once more fell sufferer to the curse of tall expectancies. That’s no longer a priority to us, although, as a result of Nvidia’s underlying basics and long-term outlook seem to be as wholesome as ever.

Continue Reading

You may also like...

Related Topics:Advanced Micro Devices Inc, Breaking News: Markets, Breaking News: Technology, business news, club earnings, Intel Corp, Investment strategy, Jim Cramer, Markets, Technology

Click to comment