Technology

Nvidia stocks are up 25% within the latter era, rallying close a file forward of tech income

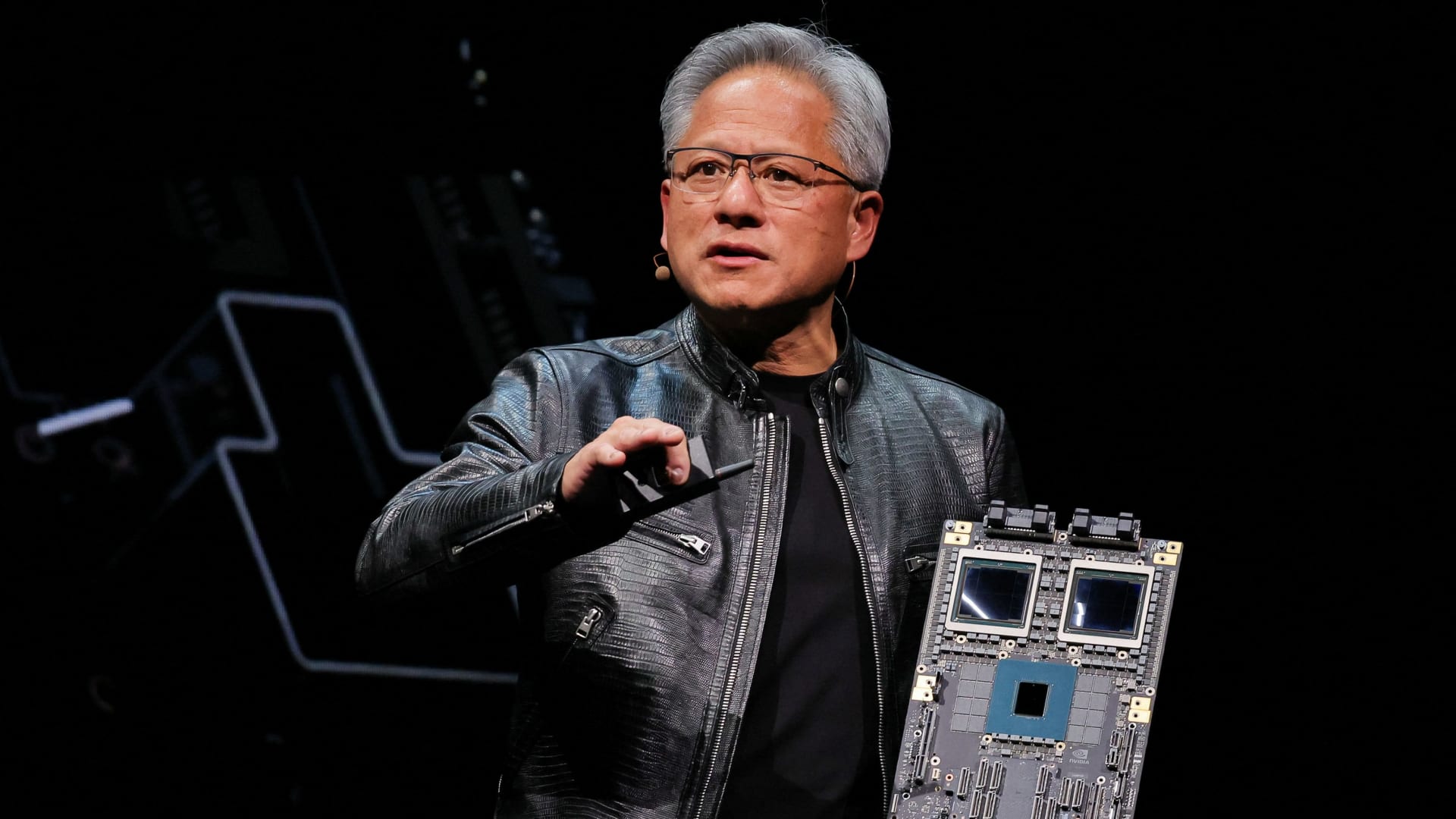

Nvidia CEO Jensen Huang gifts “Blackwell” at an tournament forward of the Computex discussion board, in Taipei, Taiwan, on June 2, 2024.

Ann Wang | Reuters

Nvidia stocks have surged 25% within the latter era and are extreme in on a file forward of tech income season within the coming weeks, when govern shoppers like Meta, Microsoft and Alphabet will replace shareholders on their anticipated investments in synthetic understanding.

Following a short lived however dramatic dip in past due August and early September, Nvidia has rebounded sharply. The secure used to be indisposed quite on Wednesday at round $132, simply shy of its extreme prime of $135.58 reached in June. Nvidia has surpassed Microsoft because the second-most worthy corporate, at the back of most effective Apple.

Nvidia has been the most important beneficiary of the AI growth, as corporations together with Meta, OpenAI, Alphabet, Microsoft and Oracle proceed to unveil applied sciences and merchandise that require hefty investments in its graphics processing gadgets, or GPUs.

In August, Nvidia reported fiscal second-quarter income that confirmed earnings rose 122% hour over hour presen web source of revenue greater than doubled to $16.6 billion. The corporate additionally gave stronger-than-expected steering for the up-to-date quarter and stated it expects to send a number of billion bucks significance of its untouched Blackwell AI chip. Call for is so prime that Nvidia anticipates shipments for its current-generation Hopper chip to extend over the upcoming two quarters.

“We see NVDA remaining the leader in the AI training and inference chips for Data Center applications,” Mizuho analysts stated in a observe Wednesday, estimating that the corporate has about 95% marketplace proportion. The analysts have a $140 worth goal at the secure however famous dangers in doubtlessly escalating export restrictions to China, geopolitical tensions relating to Taiwan or a vital pullback in AI server spending.

“Everybody wants to have the most and everybody wants to be first,” CEO Jensen Huang stated in an interview latter moment on CNBC’s “Closing Bell Overtime,” talking of the “insane” call for for the Blackwell chip. Manufacturing for the GPU, which can value between $30,000 and $40,000 in line with unit, is predicted to ramp up within the fourth quarter and proceed into fiscal 2026.

The secure rallied for alternative causes over the latter era, too. Nvidia stocks jumped 4% on Sept. 23, then a submitting confirmed Huang completed promoting the corporate’s secure.

— CNBC’s Michael Bloom contributed to this file.

Correction: Nvidia’s extreme prime of $135.58 used to be reached in June. An previous model misstated the era.

On this photograph representation, the brand of TikTok is displayed on a smartphone display screen on...

Waymo companions with Uber in order robotaxi carrier to Atlanta and Austin. Uber Applied sciences Inc....

Microsoft CEO Satya Nadella speaks at Microsoft Create AI Age in Jakarta, Indonesia, on April 30,...

Sanjay Beri, CEO and founding father of Netskope Inc., listens all over a Bloomberg West tv...

OpenAI CEO Sam Altman walks at the era of a gathering of the White Space Job...