Developers step up building in Yuexi County, Anqing town, Anhui province, China, on Sept 25, 2024.

Cfoto | Hour Publishing | Getty Photographs

BEIJING — China goals to block the constituent hunch, govern leaders stated Thursday in a readout of a high-level meeting printed via condition media.

Government “must work to halt the real estate market decline and spur a stable recovery,” the readout stated in Chinese language, translated via CNBC. It also known as for “responding to concerns of the masses.”

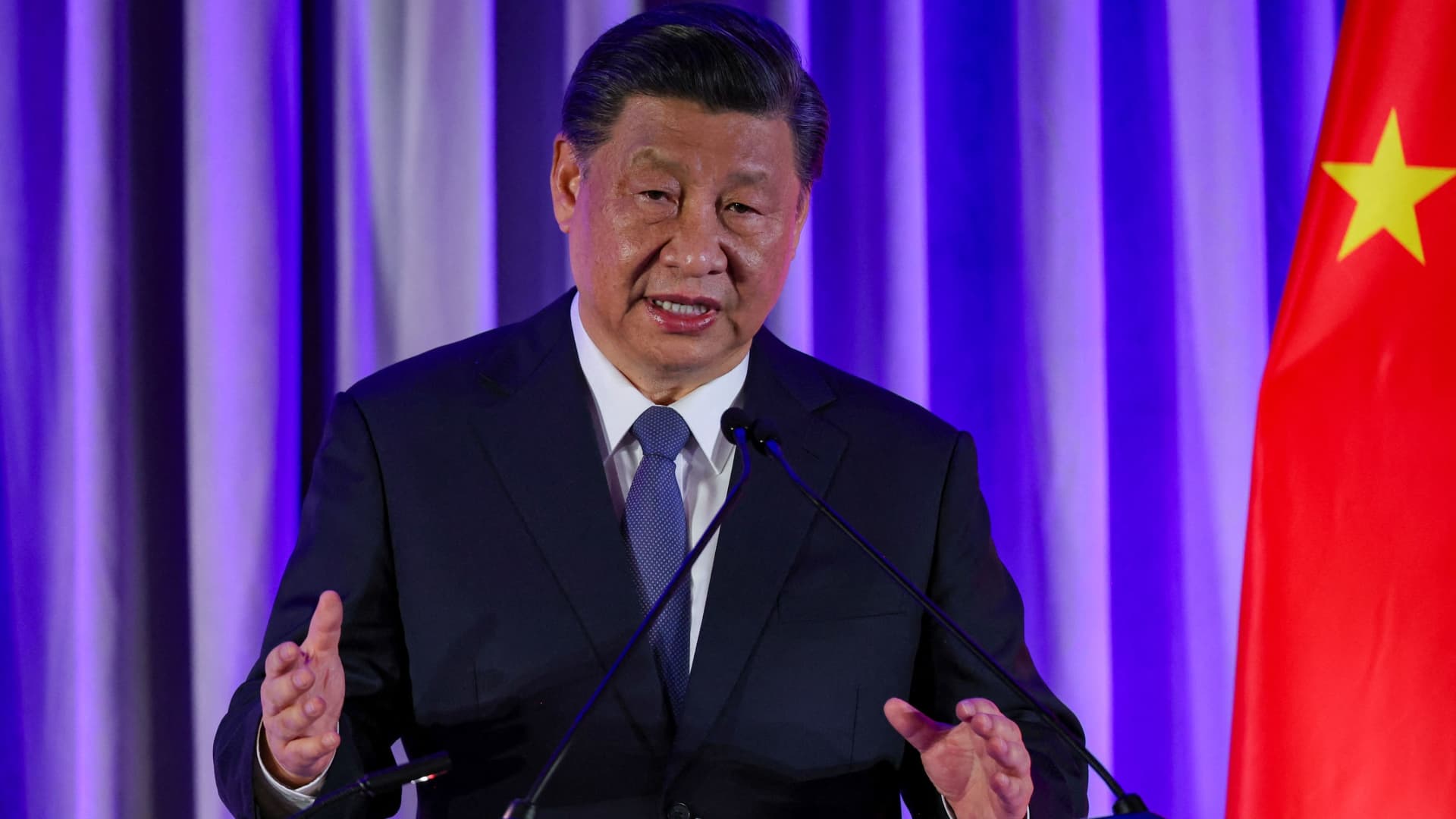

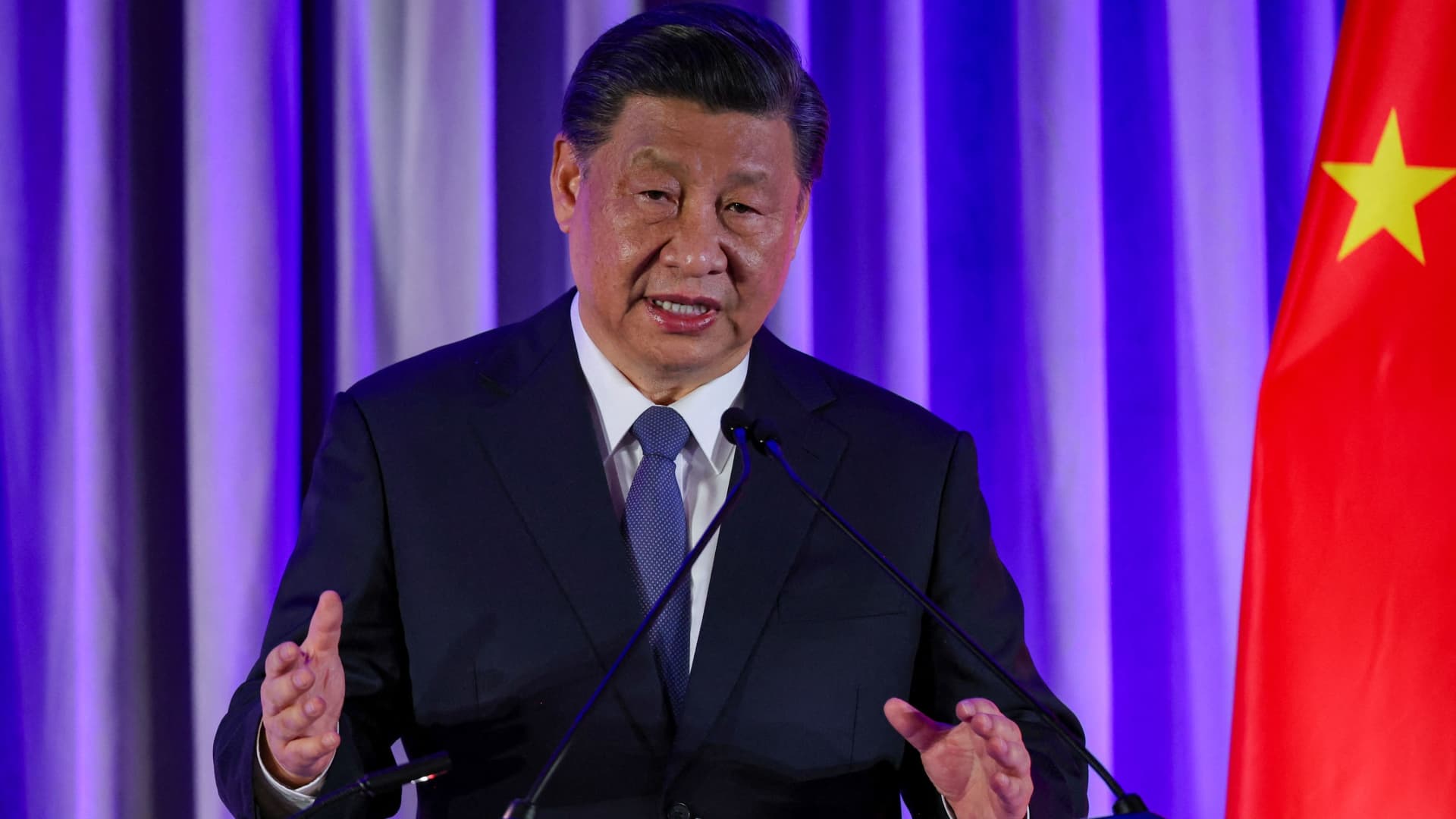

Chinese language President Xi Jinping led Thursday’s assembly of the Politburo, the second-highest circle of energy within the ruling Chinese language Communist Celebration, condition media stated.

The readout stated leaders referred to as for wholesome fiscal and fiscal coverage aid, and touched on a swath of problems from work to the getting older nation. It didn’t specify the time-frame or scale of any measures.

“I take the messages from this meeting as a positive step,” Zhiwei Zhang, president and prominent economist at Pinpoint Asset Control, stated in an e-mail to CNBC. “It takes time to formulate a comprehensive fiscal package to address the economic challenges, [and] the meeting took one step in that direction.”

Shares in mainland China and Hong Kong prolonged good points then the inside track to near sharply larger on Thursday. An index of Chinese property stocks in Hong Kong surged via just about 12%.

Actual property as soon as accounted for greater than 1 / 4 of China’s financial system. The field has slumped since Beijing’s crackdown in 2020 on builders’ majestic ranges of debt. However the abatement has additionally shorten into native govt income and family wealth.

China’s broader monetary expansion has slowed, elevating considerations about whether or not it will possibly succeed in the full-year GDP goal of round 5% without additional stimulus. Simply days then the U.S. shorten rates of interest, the Crowd’s Deposit of China on Tuesday introduced a slew of deliberate rate of interest cuts and actual property aid. Shares rose, however analysts cautioned the economy still needed fiscal support.

Reputable knowledge presentations actual property’s abatement has moderated fairly in contemporary months. The worth of unused properties offered fell via 23.6% for the 12 months thru August, fairly higher than the 24.3% let fall year-to-date as of July.

Moderate house costs fell via 6.8% in August from the prior moment on a seasonally adjusted foundation, in line with Goldman Sachs. That used to be a tiny growth from a 7.6% abatement in July.

“Bottom-out stabilization in the housing market will be a prerequisite for households to take action and break the ‘wait-and-see’ cycle,” Yue Su, predominant economist China, on the Economist Wisdom Unit, stated in a notice. “This suggests that the policy priority is not to boost housing prices to create a wealth effect, but to encourage households to make purchases. This real estate policy is aiming at reducing its drag on the economy.”

Thursday’s assembly referred to as for restricting expansion in housing provide, expanding loans for whitelisted initiatives and decreasing the passion on present mortgages. The Crowd’s Deposit of China on Tuesday stated imminent cuts must decrease the loan fee burden via 150 billion yuan ($21.37 billion) a 12 months.

Pace Thursday’s assembly didn’t lend many main points, it’s important for a rustic the place coverage directives are an increasing number of enthusiastic on the very govern.

The high-level assembly displays the surroundings of an “overall policy,” as there prior to now wasn’t a unmarried assembly to sum up the measures, Deposit of China’s prominent researcher Zong Liang stated in Mandarin, translated via CNBC.

He famous how the assembly follows the marketplace’s sure reaction to the coverage bulletins previous within the moment. Zong expects Beijing to extend aid, noting a shift from center of attention on balance to taking motion.

Tempering expansion expectancies

The assembly readout stated China would “work hard to complete” the rustic’s full-year financial objectives.

That’s much less competitive than the Politburo assembly in July, when the readout stated China would paintings to succeed in the ones targets “at all costs,” in line with Bruce Pang, prominent economist and head of study for Higher China at JLL.

That presentations policymakers are on the lookout for heart farmland between temporary expansion and longer-term efforts to deal with structural problems, he stated.

Goldman Sachs and alternative corporations have trimmed their expansion forecasts within the terminating few weeks.

The exchange in pitch concerning the financial objectives indicators “the government may tolerate growth below 5%,” the EIU’s Su stated. “We estimate real economic growth to be around 4.7% in 2024, before slowing down to 4.5% (a moderate upward revision to our previous forecast).”

“The Politburo meetings on economic deployment usually take place in April, July, and October,” she stated.

“The fact that this meeting was held earlier, along with the emphasis on stabilizing growth, reflects policymakers’ concerns about the current economic growth trend.”

Preliminary analyst reactions to Thursday’s assembly readout have been various.

HSBC stated “the tide has turned; be prepared for more proactive initiatives.” Capital Economics, at the alternative hand, stated Beijing’s trace at stimulus didn’t produce it unclouded whether or not it could come with large-scale fiscal aid.

S&P World Rankings analysts stated in a file previous this 12 months that fiscal stimulus is losing its effectiveness in China and is extra of a technique to shop for week for longer-term targets.

Senior officers in the summertime instructed newshounds that the financial system had to bear necessary “pain” because it transitioned to one in all higher-quality expansion with a larger high-tech business.

— CNBC’s Sonia Heng contributed to this file.